HANSE Interim Team Research: Home Sweet Home – can the German furniture industry defy the effects of multiple crises? Which current developments and trends could be critical to success in the future?

In recent years, the German furniture industry has suffered from the consequences of the coronavirus pandemic, such as temporary disruptions to global supply chains. Due to a lack of availability and higher oil and gas prices, raw materials such as wood, metal and foam, as well as transportation services, have become much more expensive. However, the industry benefited from the fact that people value comfort and coziness within their own four walls more in times of crisis and are therefore investing more in interior design.

As part of a HANSE Group project for a client operating in the furniture industry, HANSE Interim examined the key market trends and decisive developments and analyzed their significance and impact on future opportunities and risks in the industry.

Market overview furniture industry

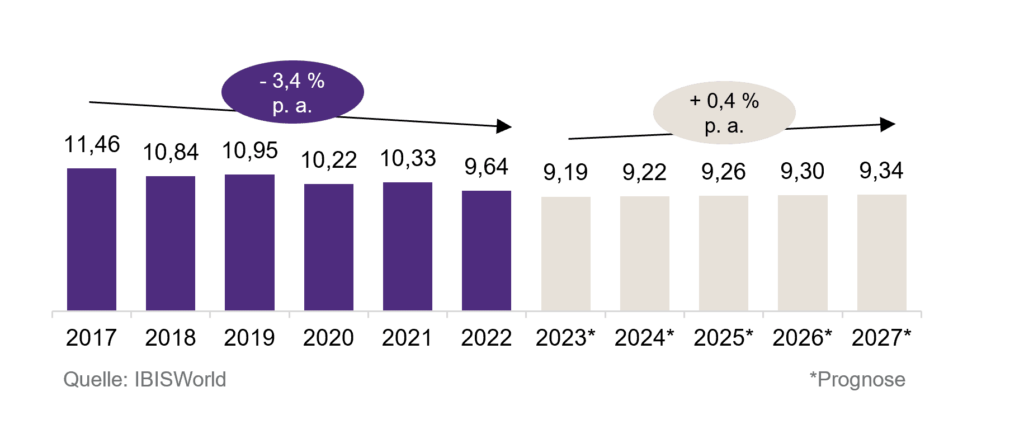

As a result of limited travel and leisure opportunities, consumers have invested their budgets in housing and furnishings. Nevertheless, sales fell by an average of 3.4% per year between 2017 and 2022.

Demand for furniture and furnishings has continued to fall in recent months – the deterioration in consumer sentiment due to high inflation rates has had a negative impact on incoming orders since summer 2022.

Industry turnover is expected to amount to €9.2 billion in 2023, which corresponds to a reduction of 4.7% compared to the previous year.

Average sales growth of 0.4% is expected from 2023 to 2028, meaning that industry sales in 2028 are likely to amount to EUR 9.4 billion.

Sales development in the German home furniture industry

(in million EUR)

The tight personnel situation in particular is becoming a long-term challenge for the predominantly medium-sized companies.

Equally decisive for sales development are

- a secure energy supply,

- the level of material and energy costs,

- disruptions in supply and logistics chains

- and slumps in demand in times of global economic and political crises.

All of this depends to a decisive extent on the further duration and development of the war in Ukraine, its consequences and political reactions.

So what specific trends and developments offer manufacturers opportunities to master this transformation?

Environmental protection and sustainable production are becoming increasingly important in the industry

Furniture manufacturers are faced with legal and social obligations regarding environmental protection and sustainability requirements in the industrial furniture production environment. Investment in sustainable production is increasing, for example in the areas of heating, energy, recycling and waste prevention.

In view of the task of developing sustainable products with recyclable materials, wood will become even more in demand as a raw material and give the price of wood a further boost.

Companies can acquire various environmental certificates. Examples include the “Blue Angel”, “Climate-neutral manufacturer” and the “PEFC” or “FSC” forest certification systems. The RAL quality mark for climate protection, which has been available since the beginning of 2022, recognizes the sense of responsibility of certified furniture manufacturers and helps climate-conscious end consumers with their purchasing decisions.

Rising demand for furniture will ensure full order books for furniture manufacturers

The high demand for construction in Germany offers a market opportunity. The unsatisfied demand for housing will boost the number of new orders and building permits again. Even though sales development in the construction industry is currently being hampered by the sharp rise in interest rates, the situation is expected to ease again as inflation subsides and interest rates fall.

The kitchen furniture business in particular may then benefit again from developments in the construction sector. However, manufacturers of upholstered furniture will also benefit.

Equally pleasing for manufacturers of home furniture is the trend towards the purchase of individual items of furniture and smaller furniture combinations, as well as the steady increase in the number of single households.

The digitalization and automation of production processes promise long-term cost benefits for companies

Although traditional craftsmanship and manual work continue to play an important role in production and serve as a selling point in the marketing of German premium products, production processes are increasingly being converted to digital and automated processes. This may include computer-controlled milling machines, laser cutters, 3D printers or robotic arms.

The advantage of digital production processes is that they allow products to be individualized and mass produced at the same time.

Although the introduction of modernized production lines requires high investments, automated processes will be crucial in order to remain competitive against foreign suppliers.

Growing share of online retail

With the accelerated expansion of digital sales channels since the coronavirus pandemic, online furniture retail is developing into a disruptive technology for the industry. In particular, the interaction between brick-and-mortar and virtual salesrooms offers opportunities for product and process innovations. While customers will primarily use online platforms for information procurement, virtual product planning and product individualization, the stationary salesroom will be transformed into a showroom with an event character.

The role of sales staff is increasingly changing from salesperson to idea provider, whose ideas can be presented using interactive terminals, OLED screens and tablets.

Conclusion

The increasing proportion of furniture imports, with which strong European competitors, some of whom are supported by EU subsidies, are forcing their way onto the German market, is a burden for industry players.

The furniture industry is under pressure on the sales side due to increasing market concentration in the retail sector with strong purchasing associations. The challenge for furniture manufacturers is to reconcile increased material prices with price competition from abroad and discount demands from retailers.

One competitive strategy is to promote awareness among end customers of the quality, sustainability and safety of furniture made in Germany.

What developments do you see in this market in the future?

With best regards

Your HANSE Interim Management

Andreas Lau

Interim finance manager brings financial stability after company takeover

From chaos to control: Interim Finance Manager optimizes controlling After a company takeover, many organizations…

19th AIMP Annual Forum 2025 for Interim Management May 9 and 10, 2025

Company transformation According to this event motto, the next AIMP Annual Forum 2025 will take…

Sport for top performance: Exercise as a success factor and drive for (interim) managers and companies

New Year’s resolutions are often ambitious: do more sport, live healthier, reduce stress. But how…