For a long time, cruise tourism symbolised boundless freedom and was seen as a driving force of European shipbuilding. Then came the pandemic — and a complete standstill. Today, the maritime sector faces a decisive turning point. Relying solely on cruise ships is no longer enough. New momentum is emerging from naval shipbuilding.

Before the Pandemic: A Boom with Signal Value

In 2019, the cruise industry reached its peak. More than 30 million people worldwide and 3.12 million Germans went on a cruise — more than ever before. Northern Germany, in particular, benefited: shipyards, ports, suppliers and the hospitality industry experienced strong growth. Cruise ships evolved into “smart cities on water”, where energy-efficient technologies and alternative propulsion systems were tested. Around 20 billion euros were invested in research and development.

During the Pandemic: Standstill on All Decks

When the pandemic began, the global cruise industry came to a sudden halt. Ships remained idle, revenues collapsed, and operating costs continued to accrue. The shipyards specialising in cruise vessels were hit particularly hard. New orders dried up, projects were delayed, and many companies had to introduce short-time work or file for insolvency.

One of the most affected was Meyer Werft in Papenburg — founded in 1795 and one of the world’s leading builders of cruise ships. In 2020, the company recorded a loss of around 180 million euros. Senior owner Bernard Meyer called it “the most threatening period since the company’s foundation.” Although the shipyard expanded into new segments such as government vessels and luxury yachts, the core business remained under heavy pressure.

Recovery with New Priorities

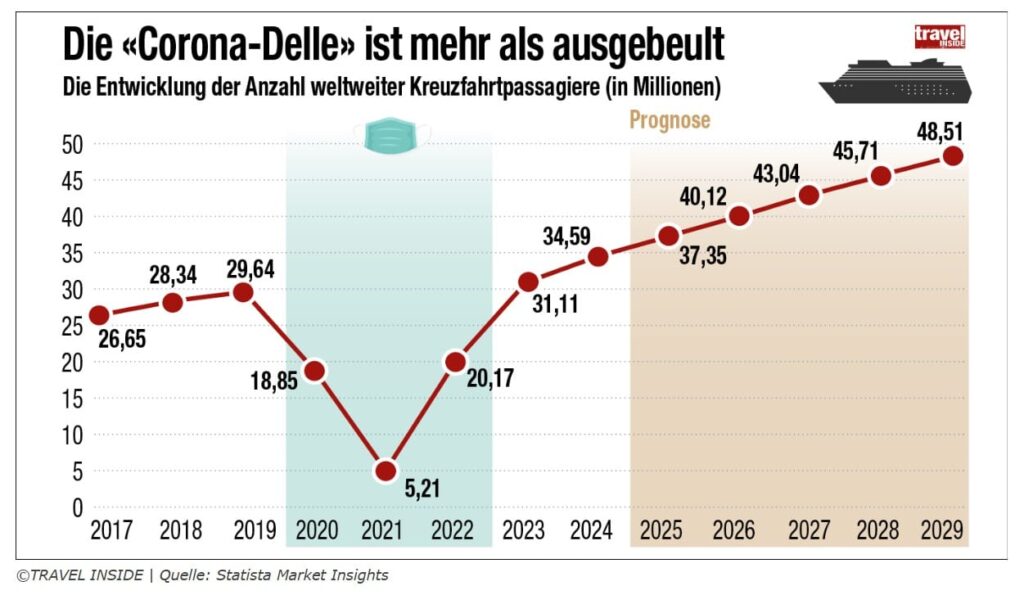

Despite the severe crisis, demand for cruises has recovered significantly. By 2024, almost 36 million people worldwide went on a cruise — surpassing even the record year 2019.

Around 3.8 million passengers came from Germany, now the world’s third-largest cruise market after the USA and China. Forecasts predict up to 40 million passengers by 2027.

At the same time, European shipbuilding remains globally dominant.

About 97 percent of all cruise ships are built in Europe, more than 20 percent of them in Germany.

In 2024, around 95 percent of the total order volume of German shipyards consisted of cruise ships and luxury yachts — clear proof of their technological strength and innovative capability.

Transformation of the Shipyards: A Necessary Course Correction

The pandemic exposed the risks of dependency on a single market. Many shipyards are now undergoing deep structural transformation. Alongside the civilian sector, naval shipbuilding is becoming increasingly important — not only economically but also strategically.

It is not the need for transformation itself that poses the problem. Both the cruise and naval shipbuilding industries have undergone many transformations over the past decades. The real challenge lies in the required speed of transformation and the need to design long-life investment assets so that they can be adapted to new demands within a short time. These new requirements call for a rapid transformation of organisations that have been successful in the past but have become too slow. This applies both to the industry and its clients.

Arne Wölper, Interim Manager Maritime Industry

The construction of submarines, frigates and research vessels secures technological expertise and preserves jobs. Naval shipbuilding has thus become a stabilising factor for the entire industry — and a key element of Germany’s ongoing security-policy “Zeitenwende” (turning point).

Political Impulses and New Orders

With the federal special fund for the armed forces and a defence budget increased to over 86 billion euros, billions are flowing into naval shipbuilding. New frigates, supply ships and submarines are filling order books, while simultaneously raising expectations for system security, digitalisation and sustainability.

A striking example is the takeover of the insolvent MV Werften in Wismar by Thyssenkrupp Marine Systems (TKMS). The site now produces sections of the new submarine type 212CD, built in identical form for Germany and Norway. The total contract value is around 4.7 billion euros. By 2028, TKMS plans to create about 1,500 new jobs, supported by investments of 220 million euros.

Meyer Werft itself is also undergoing historic restructuring. Since autumn 2024, the German federal government and the state of Lower Saxony have held about 80 percent of the company’s shares. With guarantees and new capital totalling 400 million euros, the shipyard’s competitiveness is being stabilised, with the aim of returning it to private ownership in the medium term. The long-term goal is to establish Meyer Werft as a strategic partner in naval shipbuilding and to secure its role as an innovation driver in Northern Germany.

Between Cruise and Navy: New Opportunities for Interim Managers

German shipyards are navigating between two worlds: the recovering cruise market and the rapidly growing naval segment. This dual role demands leadership that combines experience, speed and transformation competence. Interim Managers can play a crucial role here.

They bring operational expertise from restructuring and change processes, steer complex supply chains, stabilise projects and drive innovation. In shipyards like Meyer Werft, they may take on interim key roles in transformation, change management or strategic procurement.

The central goal remains clear: shipyards must remain profitable, preserve their civilian strengths and at the same time deliver on major military contracts. Interim Managers can help bridge this gap — from introducing climate-neutral technologies to modular construction methods and integrating national defence programmes.

Conclusion

The maritime industry is undergoing profound transformation. Between cruise and navy, a new hybrid future of shipbuilding is emerging. Those who embrace change with courage and bring in the right expertise at the right time can turn yesterday’s crisis into tomorrow’s strength.

Best regards

Your HANSE Interim Management

Andreas Lau

PS: A practical perspective on maritime transformation can be found in our project story “Interim Expert Maritime Industry”. Read more