HANSE Interim has organized several assignments for its CROs and CTOs in the automotive supply industry in 2024. Our research team has filtered out the challenges of the industry from various occasions for these projects and summarized the findings in this article.

The automotive industry is at a turning point. Electromobility is no longer a vision, but a necessity in order to achieve climate targets and make the mobility of the future sustainable. Countries such as China and Norway are setting the pace with innovative concepts and clear targets for zero-emission vehicles. Germany, on the other hand, is facing growing challenges while demand is stagnating.

The transition to electromobility requires not only technological innovations, but also comprehensive social changes. From political decisions and infrastructure investments to consumer acceptance – the change is complex and dynamic. This article highlights key developments, opportunities and hurdles of electromobility in global competition and at the same time offers an insight into the long-term effects on the economy and society.

What is electromobility?

Electromobility describes the use of electrically powered vehicles such as electric cars, e-bikes, electric motorcycles and e-buses. These vehicles use energy storage systems that are mainly charged via the power grid.

Current electric cars offer ranges of 150 to 350 kilometers per charge – sufficient for city traffic and applications such as delivery services or car sharing. High-priced models achieve ranges of over 500 kilometers, although factors such as air conditioning, extreme temperatures or driving behavior can influence the range.

The continuous development of battery technology plays an important role. Advances in energy density and charging speed can further increase the attractiveness of electric vehicles. The transition to more environmentally friendly battery materials is also a key objective in order to improve the sustainability of electromobility.

The importance of electromobility

Compared to vehicles with combustion engines, electric vehicles are emission-free and reduce dependence on fossil fuels. They are a key component in achieving global climate targets and make a significant contribution to reducing air pollution in urban areas.

They also score points with lower operating costs, less maintenance and advantages such as quiet driving and a long service life. Advances in battery technology further reinforce these advantages. At the same time, electric vehicles offer great potential for innovation, for example through integration into smart power grids or as energy storage for renewable energies.

Technological diversity in electromobility

Electromobility comprises various vehicle types, each of which serves specific applications:

- Battery-powered electric vehicles (BEVs): Vehicles that run exclusively on electricity and are charged at charging stations. They are particularly suitable for urban areas.

- Plug-in hybrids (PHEVs): Combination of electric and combustion engines that run on both electricity and fuel. They offer greater range and flexibility.

- Hybrids: Vehicles with a combustion engine in which the electric motor is charged by braking energy or the engine.

- Fuel cell vehicles: Hydrogen-powered vehicles that only emit water vapor. They are considered promising for long-distance and heavy-duty transportation.

The diversity of these technologies underlines the complexity of electromobility and shows that there is no universal solution. Instead, different approaches need to be coordinated and promoted.

Current market overview of e-mobility

The most commonly used electric vehicles in Germany are battery electric vehicles (BEVs) and plug-in hybrids (PHEVs).

Germany recorded a total of 700,200 new registrations of BEVs and PHEVs in 2023. This puts Germany in third place worldwide – behind China, the leader with 7.3 million electric vehicles and plug-in hybrids sold, and the USA with 1.42 million new registrations.

Norway is particularly noteworthy, where 90% of new registrations are fully electric or plug-in hybrids.

At the end of 2023, there were around 42 million electric cars worldwide, more than half of which were registered in China. Germany had a share of 2.3 million, but suffered a 29% drop in sales in 2024.

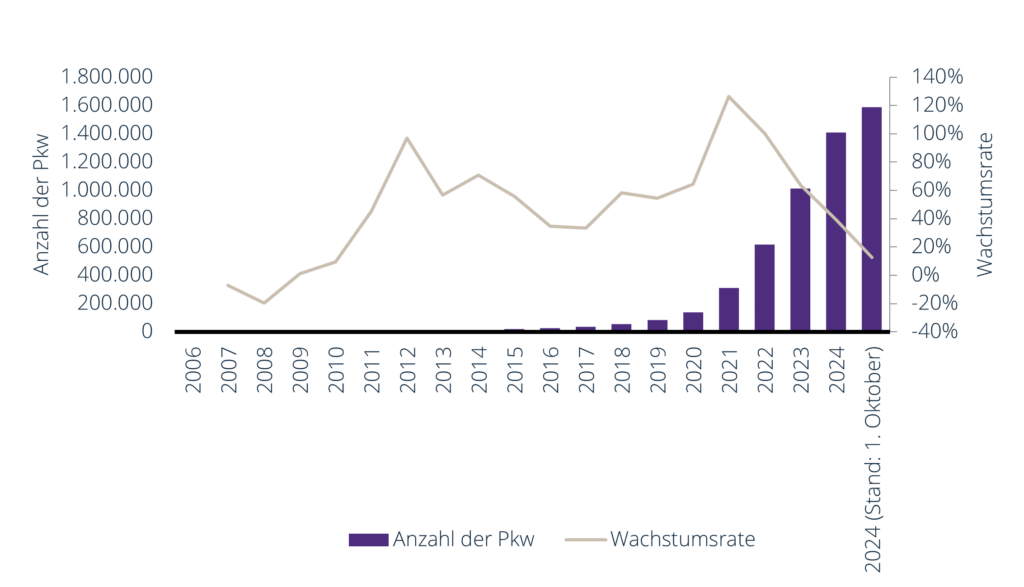

Number of electric cars in Germany from 2006 to October 2024

Drivers of growth

The growth of electromobility has so far been driven primarily by government subsidies. The Electric Mobility Act (EmoG) provides targeted incentives for switching to electric vehicles by offering tax benefits. At the same time, it motivates local authorities to push ahead with the expansion of the charging infrastructure. It also creates special privileges for electric vehicles in public spaces, such as free parking spaces.

The federal government is also promoting innovations in the field of hydrogen mobility, which are particularly interesting for emission-free long-distance journeys and heavy commercial vehicles and could expand the diversity within e-mobility.

Another growth driver for a long time was the environmental bonus, a financial incentive for the purchase of electric vehicles. This was introduced by the state in 2016, as electric vehicles are particularly expensive to purchase. Until December 18, 2023, e-cars were last subsidized with up to 6,750 euros. However, because the federal government’s Climate and Transformation Fund was short of 60 billion euros, the resulting savings in the federal budget in 2024 ultimately led to the scrapping of the environmental bonus.

Until the end of 2022, the innovation premium was a temporary extension of the environmental bonus introduced during the COVID-19 pandemic to provide additional support for electromobility. It doubled the state subsidy for the purchase of electric vehicles and plug-in hybrids to boost sales of e-vehicles in a difficult economic situation and thus enabled a purchase premium of up to 9,000 euros. Government subsidy programs are also leading to an increase in demand in other countries. In Norway, for example, more vehicles with hybrid and electric drives than with combustion engines were registered for the first time in 2017, which can be attributed to considerable support. The state levies high taxes on conventional cars, while no taxes are payable on the purchase of clean vehicles. In addition, there is a low vehicle tax and free use of toll roads and state ferries. Norway will only sell zero-emission cars from 2025.

Challenges of the automotive industry

The German automotive industry is currently facing numerous challenges that are making the transition to electromobility and its sustainable and widespread use more difficult.

The batteries currently lose capacity after around 8 to 10 years and therefore become insufficient for vehicle operation. Until now, they have been considered unusable and consequently disposed of.

The disposal and recycling of these batteries represents both an ecological and an economic challenge, as valuable resources are lost and high environmental costs are incurred.

The insufficiently developed charging infrastructure in Germany is also still perceived as inadequate by potential buyers, despite accelerated expansion. In rural areas in particular, there is often only one, or even no, charging station in villages.

A nationwide charging infrastructure is crucial to enable people to switch to e-mobility.

The automotive industry is facing significant hurdles:

- Battery recycling: After 8 to 10 years, batteries lose capacity and are often disposed of, wasting resources and causing environmental costs.

- Charging infrastructure: Despite progress, the infrastructure in Germany is inadequate, especially in rural areas.

- High purchase costs: Electric cars are more expensive than vehicles with combustion engines, which is exacerbated by expiring subsidies.

- Market dynamics: German manufacturers such as Volkswagen are struggling with competition from China, which offers cost-effective and technologically advanced models.

On the buyer side, the high purchase costs continue to be a challenge, which is currently dampening the market, especially in view of expiring premiums.

German car manufacturers such as Volkswagen are struggling to keep pace with the current market dynamics. In particular, the lack of a competitive, cost-effective e-model has caused VW to fall behind.

Expectations of market development

The end of national subsidy programs and the resulting fall in demand for electric vehicles as well as technological setbacks are putting pressure on the German automotive industry, while the international market – particularly in China – continues to grow strongly.

Chinese manufacturers such as BYD are dominating with low-cost and technologically advanced models, which is causing increasing difficulties for German companies such as VW and Ford. VW is planning to close plants and cut tens of thousands of jobs in Germany, while Ford is also cutting around 4,000 jobs in Europe by the end of 2027, 2,900 of them in Germany alone. Both companies are thus responding to falling sales of electric vehicles and growing competition.

There is a lack of affordable e-models and clear political framework conditions, which is making the transformation more difficult.

The German automotive market is therefore facing the challenge of becoming more flexible and innovative in order to remain competitive, while at the same time there is a threat of massive job losses.

The current situation is also having an impact on the German supplier industry, which is heavily dependent on the production output and strategic decisions of car manufacturers. Large companies such as Bosch, Continental and Schaeffler are currently being forced to cut thousands of jobs. Medium-sized companies such as Gerhardi Kunststofftechnik also recently had to file for insolvency due to high energy costs and pressure to transform.

There is also uncertainty in the USA regarding the future of electromobility. According to media reports, the new Trump administration is planning to withdraw climate protection measures such as stricter efficiency standards and the tax rebate of USD 7,500 for electric vehicles. This could slow down the momentum of the e-car market. While Tesla boss Elon Musk is already a technological leader and therefore sees an advantage for his company, competitors such as GM and Ford are much more reliant on subsidies to expand their electric vehicle programs.

Who will benefit from e-mobility in the future?

The situation currently looks rather bad for the once major German car manufacturers.

- The boom in electromobility will primarily benefit those companies that were early adopters of this technology. Manufacturers such as Tesla and BYD are market leaders and are already reaping the rewards of their pioneering work.

- Companies that invest in new technologies such as batteries, charging infrastructures, intelligent vehicle software or innovative materials are also well positioned from the supplier industry to benefit from the boom.

- In addition, research into sustainable production methods and recycling technologies continues to offer profit opportunities as the focus on more environmentally friendly solutions and the circular economy grows.

- Companies that pick up on these trends in good time can gain a competitive advantage in the long term and benefit from the growing demand for e-mobility solutions.

Conclusion

The current crisis at Volkswagen, one of Germany’s largest car manufacturers, highlights the difficulties faced by traditional manufacturers in the transition to electromobility. Overcapacity and weakening demand are forcing VW to cut production. At the same time, pressure from Chinese competitors is putting pressure on the company, as these manufacturers offer cost-effective and technologically mature models. The situation at VW is a good example of how important flexibility, innovation and cost-efficient production are for the future of the industry.

In the USA, too, it is currently uncertain how the economy and electromobility will develop. Nevertheless, electromobility is a decisive path to a more sustainable future. Despite the challenges, the transition to electric vehicles is essential in order to achieve global climate targets and ensure future-proof and sustainable mobility.

The transformation to electromobility is a decisive measure for a sustainable future. Manufacturers and suppliers who act flexibly and innovatively will be able to adapt to the market changes and benefit from the increasing demand.

How can we all work together to promote electromobility and create sustainable mobility for future generations?

With best regards

Your HANSE Interim Management

Andreas Lau