Between rising insolvencies, shifting consumer behavior and increasing competitive pressure.

The German retail sector is undergoing profound structural change. As a central pillar of supply, employment and vibrant city centers, it is simultaneously facing considerable pressure to adapt. Small and medium-sized retailers in particular are reaching their limits as customer behavior, cost structures and competitive dynamics shift at the same time.

Insights from a current retail project, combined with ongoing market analyses, provide a clear picture that goes beyond headline revenue figures.

Current Situation

Consumer sentiment remained subdued at the end of 2025. Nevertheless, the German retail sector recorded moderate overall revenue growth of around 2.4 percent for the year. Growth was once again driven primarily by online and mail-order retail, which expanded by nearly 11 percent. While its overall share remains below that of brick-and-mortar retail, it continues to gain relevance.

Cosmetics and healthcare products performed above average. In contrast, the textile and apparel segment recorded a decline of around one percent.

More decisive than revenue growth itself, however, is profitability. Despite nominal growth, earnings remain strained for many companies.

In 2025, the number of retail insolvencies reached approximately 2,500, marking the highest level in nearly a decade. Many retailers experienced persistent consumer caution. Spending decisions are more deliberate, and price sensitivity has increased.

Looking ahead to 2026, roughly one third of retail companies expect a further deterioration in business conditions.

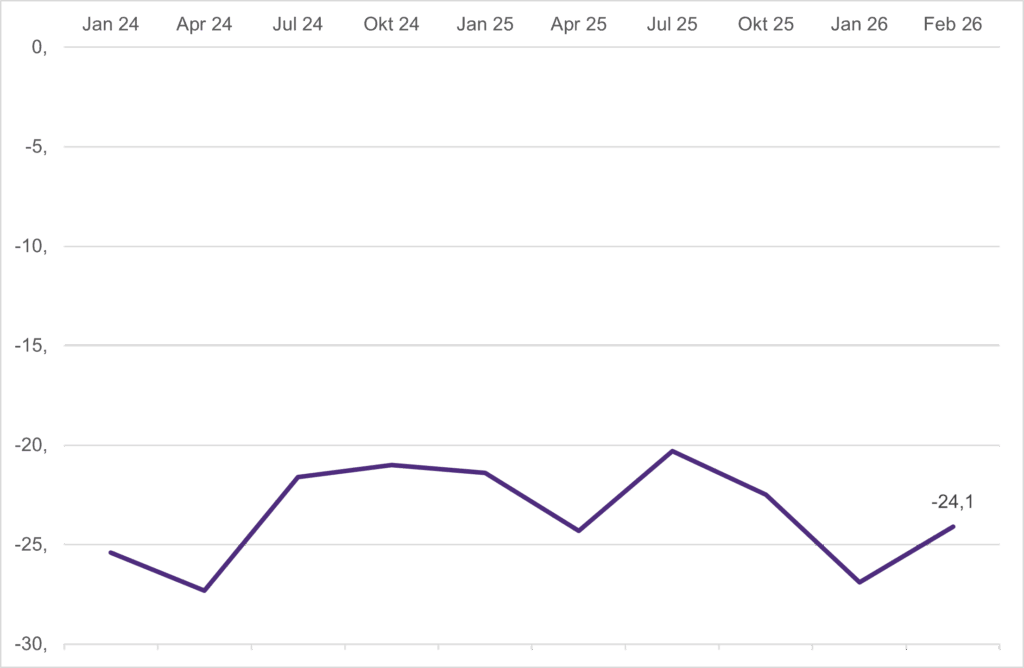

Development of the GfK Consumer Climate Index 2024–2026

Source: GfK Consumer Climate Germany, February 2026, own presentation

Structural Challenges

Behind the overall figures, pressure at the company level continues to intensify. Weak economic momentum, limited growth impulses and ongoing uncertainty in the broader economic environment further exacerbate the situation.

Costs for energy, rent, logistics and personnel continue to rise. At the same time, price increases can only be passed on to a limited extent, increasing margin pressure. In the non-food segment in particular, subdued demand has a significant impact.

Additionally, there is a structural oversupply of retail space. In weaker locations, footfall is declining, vacancies are increasing and undifferentiated concepts are losing attractiveness. As a result, many city centers remain under pressure.

Labor shortages and the lack of qualified staff not only complicate daily operations but also slow necessary transformation processes. At the same time, increasing regulatory requirements consume valuable resources, especially in small and medium-sized enterprises.

Competitive pressure continues to intensify. Online platforms and international low-cost providers are further increasing price competition. Simultaneously, investment needs in digital infrastructure, data capabilities, logistics and omnichannel solutions are rising. For many smaller retailers, financing these investments is a considerable challenge.

This combination of factors is leading to growing restructuring activity and rising insolvency figures, particularly in the non-food and fashion segments.

Trends and Shifts

Despite these pressures, clear development trends are emerging. Online retail continues to grow, albeit at a more moderate pace than during the boom years. Successful retailers are integrating physical stores, online shops, apps and services such as click and collect into a consistent, connected customer experience.

Social commerce is gaining importance. Products are increasingly discovered and purchased directly via platforms such as Instagram, YouTube and TikTok. Live shopping formats combine entertainment, consultation and immediate purchasing options, particularly appealing to younger target groups. At the same time, the role of physical stores is evolving. They are becoming less pure sales points and more spaces for service, consultation and experience. Retailers that want to remain competitive offline must offer more than shelf space

Opportunities Amid Change

These developments also create clear opportunities for companies willing to actively shape their future.

A distinct positioning and a coherent product assortment enable differentiation. Sustainability and transparent supply chains strengthen credibility and trust. Local visibility via digital channels can generate reach with manageable investment.

Customer loyalty develops where customers feel understood and well supported. Personalized advice, events, workshops and live formats provide added value that purely online providers cannot easily replicate. Cooperation models, such as shared logistics or retail space, can help reduce costs and expand reach.

A decisive success factor remains strong teams. Well-led, motivated employees contribute to internal stability and external perception. Combined with modern digital processes, this results in greater operational clarity, reduced friction and improved efficiency.

Outlook and Conclusion

The retail sector is entering a phase of clarification. Rising costs, labor shortages and intense competition are increasing pressure, particularly in stationary non-food retail. At the same time, technological developments and new sales channels offer real opportunities for companies prepared to consistently adapt their business models.

The key question will be whether necessary structural adjustments are implemented without further delay. Clear positioning, well-developed omnichannel strategies, digital efficiency and an active role within local markets are no longer optional extras but prerequisites for stability.

In the short term, the situation remains tense. Reliable economic policy conditions will therefore be essential. The German Retail Association is calling for tangible relief measures and structural reforms to restore sustainable prospects for the sector.

Kind regards,

Andreas Lau and Hannah Schäfer

on behalf of HANSE Interim

Sources

Destatis (Federal Statistical Office of Germany): Press releases and Fachserie 7, Reihe 1: Retail turnover 2025 (nominal and real), turnover development by product groups, and online and mail-order retail (WZ 47.91)

GfK: GfK Consumer Climate Germany, monthly reports 2025

German Retail Association (HDE): HDE business surveys 2025/2026 and industry reports on current business conditions and expectations in the retail sector

IWH Halle (Leibniz Institute for Economic Research Halle): IWH Insolvency Trend 2025, insolvencies by sector (WZ 2008), quarterly evaluations

Creditreform: Insolvencies in Germany 2025, economic research and sector analysis retail