The printing industry is needed, but the challenges are high

The print and media industry is undergoing dynamic change, characterized by digital transformations and the impact of global events such as the coronavirus pandemic. The industry is not only facing ongoing challenges, but also recognizes numerous opportunities to position itself in the new market situation.

As part of a HANSE Group project with interim managers and consultants for a leading client in the printing industry, HANSE Interim has examined the key market developments as well as the decisive developments and analyzed them with regard to their significance and impact on the future opportunities and risks of the industry.

Current situation in the printing industry

The printing industry has undergone significant structural changes in recent years. Digital alternatives have increasingly replaced traditional print products, while digital printing has gained in importance. Following the pandemic-related slump, sales have only slowly increased again and remain below pre-crisis levels. Reports of insolvencies and site closures are still the order of the day.

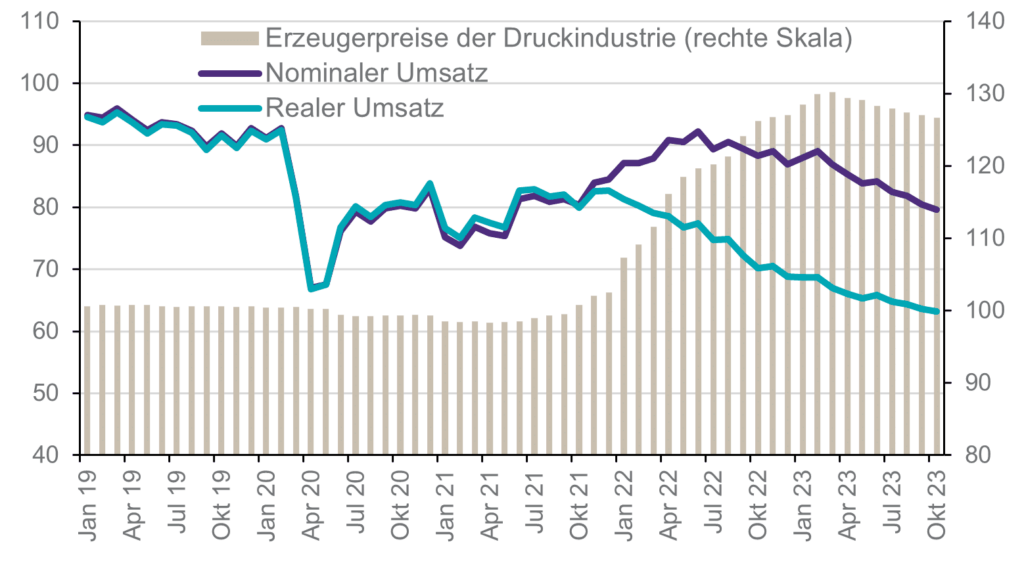

In 2020, the coronavirus crisis caused the sharpest slump in production since 1991. This was followed by a recovery in companies’ turnover and production data in the two years that followed, but the figures were dominated by the sharp rise in prices caused by supply bottlenecks and, in some cases, extremely high procurement costs.

Real declining sales in the printing industry since the beginning of 2022 despite increased sales prices (index 2015=100)

Prices for energy and printing paper rose in particular, but other cost items such as printing plates, transport/logistics and IT costs also saw serious increases. Many print shops were unable to pass this on to the same extent.

The companies in the sector performed differently depending on the segment. In commercial printing, companies are dependent on the economic situation and companies’ advertising budgets. This segment was hit particularly hard. Conversely, label and packaging printers have been able to weather the crisis comparatively well so far thanks to the special boom in the mail order business.

The economy cooled somewhat in 2023. On the cost side, however, there were some signs of easing again.

Supply bottlenecks and prices for printing paper and energy sources declined. However, as paper mills in the graphic paper sector took capacity off the market due to the decline in demand, there was not quite as much relief in this paper segment. Overall, procurement costs have also not yet returned to pre-corona levels.

Looking to the future

According to a survey by Apenberg & Partner, 35% of printing companies expect the market to remain stable and 55% expect it to decline in 2025. Heatset web offset print shops are particularly pessimistic, as they are suffering greatly from the decline in advertising brochure, catalog and magazine printing.

These print shops are faced with declining circulation figures, a continuing shift to digital media and increasing price pressure. The earnings situation of these companies remains strained as advertising budgets continue to be diverted to digital channels.

In contrast, digital print shops are somewhat more optimistic: 29% of them expect their earnings situation to improve due to the increasing demand for personalized print solutions and shorter production cycles.

Overall, only a minority believe in a positive development. Furthermore, only 15% of those surveyed are prepared to buck the trend by investing in new stages of the value chain.

Trends and developments

The industry is showing several clear trends:

Digitization: ongoing digitization is a key issue. Print service providers must adapt to new technologies in order to remain competitive. AI and automation are increasing efficiency and optimizing production processes.

Sustainability: The focus on sustainable practices is growing. More and more companies are investing in environmentally friendly materials and processes to meet the increasing demands of customers and regulators. Recyclable paper, biodegradable materials and environmentally friendly inks are increasingly in demand. Print shops that focus on sustainability gain a competitive advantage.

Growth in packaging and label printing: The boom in e-commerce is leading to increased demand for packaging and label printing. It is predicted that packaging will account for around two thirds of the total print volume by 2025..

Current challenges

Despite these positive developments, the industry is facing considerable challenges:

Rising costs: increased prices for energy and raw materials are placing a considerable burden on production costs.

Shortage of skilled workers: The lack of qualified workers is another critical issue that limits the production capacities of print shops.

Competition from digital media: Competition from digital alternatives remains high, which increases the price pressure on traditional print products.

Other challenges include fluctuations in orders/workload and the weak economic situation.

Opportunities for the printing industry

Despite the challenges, there are also promising opportunities:

Innovation through technology: companies that invest in new technologies and automation can increase their efficiency and take advantage of new market opportunities.

Sustainable printing solutions: The development of environmentally friendly products and processes enables print shops to gain a competitive advantage.

Personalization and on-demand printing: The growing demand for personalized print products is opening up new business areas and sources of revenue.

New business areas: 3D printing, sustainable packaging and interactive, personalized print products offer print shops new opportunities to differentiate themselves. The trend towards data-driven business models and the development of new services such as on-demand printing are opening up further market opportunities.

Conclusion

The printing industry is undergoing a transformation process that offers both challenges and opportunities. How will the industry develop in the coming years? What strategies should companies pursue in order to position themselves successfully in this dynamic environment?

How do you see the future of the printing industry? What experiences have you had?

With best regards

Your HANSE Interim Management

Andreas Lau