HANSE Interim Team Research: Nicht auf Rosen gHANSE Interim Team Research: Not on a bed of roses? How can the mattress industry in Germany master the turnaround and which trends will be critical for success in the future?

The German mattress industry has already been recording significant sales declines for several years. The main reasons for the downward trend were, on the one hand, strong price and predatory competition from low-priced imports and, on the other hand, the consolidation of upstream and downstream industries.

Within the scope of a project of the HANSE Group for a client active in the mattress industry, HANSE Interim examined the central market developments as well as the decisive developments and analyzed them with regard to their significance and impact on the future opportunities and risks of the industry.

Market overview mattress industry

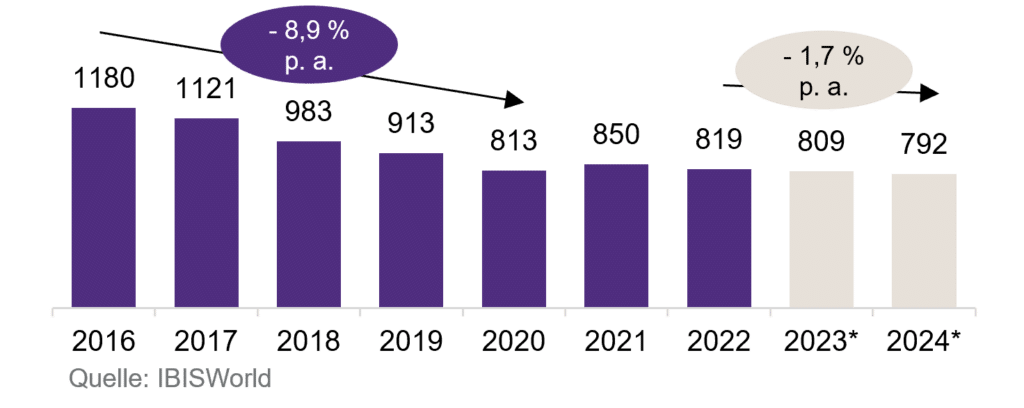

Since 2016, the industry has seen a declining sales volume of approximately 8.9% per year on average.

Rising imports from abroad

Due to the negative economic impact of the pandemic in 2020 and the sluggish recovery in 2021, the demand for mattresses has shifted to the low-price segment.

In order to secure their sales, the major furniture retailers are therefore replacing mattresses and bed frames from German production, which are mostly in the upper price segment, in their product ranges with lower-priced products from abroad.

Umsatzentwicklung der deutschen Matratzenindustrie

(in Mio. EUR)

The lower sales in 2022 were also due to the limited availability of foam and wood products. High logistics, transport and energy costs led to further price increases for mattresses.

Growing online trade – especially one-fits-all mattresses

One-fits-all mattresses, which are sold exclusively via the internet, also continue to be in vogue. These include brands such as Bett1 and Emma, which quickly gained relevant market share through very aggressive advertising on TV and social media -> “the best-selling mattress in Germany.”

Products offered are essentially in the lower price segment (EUR 199). As a result, retail demand has fallen significantly in recent years. In addition, the poor image of specialist retailers created by price agreements continues to inhibit consumption.

As a result of the pressure from online retailers and foreign manufacturers, German companies are thus faced with the challenge of adapting their product portfolio, distribution and strategic orientation to the changed market requirements.

So what specific trends and developments offer manufacturers opportunities to manage this transformation?

1. specialization

German mattress manufacturers are increasingly offering premium and niche products that focus on quality features such as “Made in Germany,” lying comfort, a long service life and special properties depending on customer requirements, such as waterproofness. In addition, many players in the industry are withdrawing from the mass market and focusing on niche markets. Niche segments such as the manufacture of anti-decubitus mattresses and other medical mattresses are particularly attractive. In addition, certain specialty mattresses feature flame-retardant, blood- and urine-resistant covers.

2. online sales or multichannel

By combining stationary showrooms with online sales channels and technological innovations, as well as uncomplicated exchange options for goods purchased online, it has been possible to overcome the resistance of traditional consumers to buying mattresses online in recent years and to exploit major growth potential in the online market.

3. reduction of the product range

Die Reduktion des Produktsortiments ist ein weiterer Erfolgsfaktor innovativer Matratzenhersteller. Anbieter, die wie Bett1.de und Emma ihr Produktsortiment ausdünnen und auf einige Kernprodukte fokussieren, werden sich künftig am Markt behaupten können, was sich nicht nur in der hohen Nachfrage zeigt, sondern auch in der Möglichkeit zur Kostenreduktion, indem sowohl Forschungs- und Entwicklungskosten als auch Beratungsaufwand eingespart werden können.

4. sustainable products

Due to increasing health awareness, end consumers are placing more and more importance on the health effects of the products they use. Last but not least, consumers’ increasing environmental awareness calls for sustainable and fair furniture production, energy-efficient living concepts, and trend-conscious furniture made from re- or upcycling processes. This is reflected, among other things, in the rising sales of natural mattresses. In terms of current sales, their market share is negligible, but they are steadily expanding it. In view of the development of customer preferences and the progress made in the costly care of such mattresses, growth in this segment is expected to continue.

Conclusion

Strong price competition from manufacturers in other EU countries and China is likely to intensify further and cause financial difficulties for smaller manufacturers in particular. Over the next five years, industry sales are expected to decline by an average of 1.7% per year. At the same time, however, there is growth potential in the industry in the booming online mattress business, as well as through the growing sustainability and health awareness among the population, which increases the willingness to pay for quality products with green seals of approval.

With the right strategic orientation, taking into account current customer needs, there are therefore still opportunities for German mattress manufacturers to achieve the turnaround and soon be back on roses

What developments do you see in this market in the future?

With best regards

Your HANSE Interim Management

Andreas Lau

When wind power meets financial strength: How an interim manager built a new treasury function

A company in the offshore wind energy sector is growing rapidly, driven by large-scale projects,…

Team Research: Steel between crisis and climate protection

Steel is the backbone of numerous industries – from construction and mechanical engineering to the…

Perspectives for companies in transition | HANSE Interim award

Restructuring 2025 – what successful companies do differently and award for HANSE Interim The last…

Invitation to the AIMP Academy 2025

Your way into interim management! The AIMP Academy is the training program of the Association…

Interim finance manager brings financial stability after company takeover

From chaos to control: Interim Finance Manager optimizes controlling After a company takeover, many organizations…

19th AIMP Annual Forum 2025 for Interim Management May 9 and 10, 2025

Company transformation According to this event motto, the next AIMP Annual Forum 2025 will take…

Sport for top performance: Exercise as a success factor and drive for (interim) managers and companies

New Year’s resolutions are often ambitious: do more sport, live healthier, reduce stress. But how…

Electromobility: Transformation of the automotive industry and our mobility – a field of application for interim CROs and interim CTOs

HANSE Interim has organized several assignments for its CROs and CTOs in the automotive supply…

Our growth brings us to a new location – just in time for St. Nicholas’ Day!

Advent is just around the corner, and we have some special news to share: HANSE…