Steel is the backbone of numerous industries – from construction and mechanical engineering to the automotive sector. Its versatility and stability make it indispensable, but the German steel industry is facing massive challenges: high competitive pressure, rising energy prices and the necessary transition to climate-friendly production. Is Germany’s steel industry still competitive? And how can it successfully master the transformation to sustainability?

As part of a project for a client in the steel industry, HANSE Interim analyzed the key market developments as well as the decisive challenges and opportunities within the industry.

What is steel and why is it so essential?

Steel consists mainly of iron and is known for its hardness and versatility. Iron itself is relatively brittle, reacts very sensitively to water and oxygen in particular and rusts quickly. The main reason for this is the carbon contained in iron. Pig iron has a carbon content of 4%, which makes it brittle and difficult to shape. This makes iron unattractive for many industries.

This is where steelworks come into play: the iron is heated so intensively that the carbon content burns off and falls to a total of less than 2%. By incorporating other elements, so-called alloys can be created which, depending on the intended use, lead to different properties in terms of hardness, flexibility and malleability. Some types of steel are better able to withstand mechanical stress, while others are particularly weatherproof or resistant to oxidation. Steel therefore has a wide range of applications in many different branches of industry.

In addition to its technical versatility, steel is also an economic factor: as one of the most widely used materials in the world, its production has a huge impact on global trade and value chains.

How is steel produced? A little digression.

Steel can be produced in two different ways: in a blast furnace or in an electric furnace. In the blast furnace process, the resources required for the steel are first produced: Iron ore is melted together with coke, a fuel obtained from coal. The high temperatures lead to complex reactions, so that oxygen is extracted from the iron ore. The result is pig iron.

It is only in the steelworks that pig iron is turned into flexible, malleable steel. There, the pig iron is then mixed with steel scrap and enriched with oxygen in an oxygen furnace to reduce the carbon content.

This produces crude steel, which is then refined by adding alloying elements such as nickel or chromium, poured into molds and rolled to obtain the desired structure.

In the electric furnace process, recycled steel scrap is used as the starting material instead of iron ore. It is melted in an electric furnace, cleaned and then refined using alloys. This process is more sustainable and more energy-efficient, as it does not require coal and produces lower CO₂ emissions.

The blast furnace is still the traditional method of production, but the electric furnace is becoming increasingly important due to its environmental friendliness.

Steel production is particularly climate-intensive and is currently responsible for up to 28% of total industrial CO₂ emissions in Germany. Process-related carbon dioxide emissions are largely caused by the combustion of coke. Additional emissions result from the use of electricity generated from fossil fuels. This makes the steel industry one of the industries with particularly high energy requirements.

Despite its climate-intensive production, however, steel also impresses with its resource efficiency. Although the original production process releases a lot of CO2, steel is completely recyclable, making it one of the most sustainable materials and thus making an enormous contribution to conserving resources. It can be seamlessly fed back into the economic cycle and is therefore of central importance in a sustainable and resource-conserving industry.

The importance of the steel industry in Germany

The steel industry plays a central role in German value chains and is closely linked to numerous branches of industry. It forms the foundation for key sectors such as the automotive industry and mechanical engineering, with around 20% of intermediate inputs in mechanical engineering and 12% in vehicle construction coming from the steel industry.

Sectors such as electrical engineering, construction and steel and metal processing are also important customers.

In Germany, the steel-intensive industries employ around 4 million people and account for around two thirds of industrial jobs.

More than 80,000 people are employed directly in the steel industry itself. Within Germany, thyssenkrupp AG and Salzgitter AG are the most important steel producers.

The current situation in the steel industry. Germany in global comparison

An experienced interim manager from HANSE Interim took on responsibility for a company-wide transformation project, from site assessment and the development of a sustainability strategy through to the operational implementation of initial measures. It became particularly clear how strongly geopolitical developments, technological innovations and regulatory requirements influence the scope for action of industrial players.

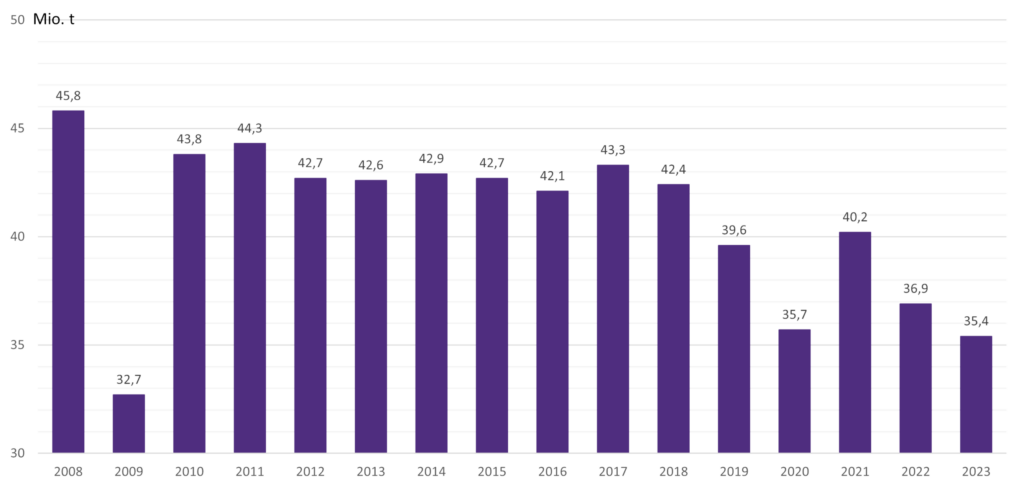

China was the world’s largest crude steel producer in 2023 with around 1.1 billion tons and a 54% share, followed by India and Japan in second and third place. Meanwhile, Germany produced around 35.4 million tons of crude steel in 2023, putting it in 7th place in the global ranking of crude steel production in 2023.

Development of German crude steel production

Within Europe, Germany remains the leader in steel production ahead of Italy, France and Spain, but German steel production reached its lowest level since the financial market crisis in 2009 in 2023. Production thus fell to a historic low, with electric steel production falling particularly sharply by 11%.

At the same time, the Asian region remains the world’s largest steel consumer with over 1.2 billion tons, with China leading the way – both as a production location and as one of the largest steel consumers per capita behind South Korea.

According to forecasts, this trend will continue in 2025, particularly in emerging countries with high infrastructure requirements.

Overall, the global steel market is characterized by intense international competition, which in some cases has a negative impact on achievable prices. Steel production and steel exports from China in particular have had a significant impact on the global steel market in recent years.

Challenges in the industry

Recent developments at thyssenkrupp illustrate the difficult situation in the industry. Due to weak demand, the company announced in November 2024 that it would be cutting around 11,000 jobs and closing a production site with the aim of becoming more competitive again.

As early as 2016, IG Metall warned that the German steel industry’s existence could be threatened. The aforementioned core problems in the industry remain to this day.

- International competition: Subsidized and cheap steel from China is distorting competition and jeopardizing the competitiveness of German manufacturers.

- Climate protection & CO₂ costs: Stricter emissions regulations and rising CO₂ certificate costs increase production costs and could put the brakes on investment.

- High energy prices: Energy-intensive production is additionally burdened by rising electricity and raw material costs.

- Decarbonization & technology change: The switch to climate-friendly processes such as hydrogen-based steel production is necessary, but financially and infrastructurally challenging..

The climate-intensive production of steel in particular currently poses a major challenge for the industry: every year, around 55 million tons of CO2 are emitted during steel production in Germany, which is mainly due to the combustion of coke and the use of electricity from fossil fuels.

Political measures are urgently needed to make the transformation to climate-friendly production processes economically viable. This includes competitive electricity prices, subsidies for investments and reliable framework conditions to ensure that the German steel industry remains competitive at an international level and at the same time enables a sustainable reduction in its CO₂ emissions.

The future of German steel production

Steel is and will remain an important raw material that we cannot do without in the future. It is essential for the production of numerous products, including in the energy transition. For example, steel is needed for the production of heat pumps, wind turbines and photovoltaic systems – a contradiction that needs to be resolved in the context of climate change.

In order to support the German steel industry in its transformation to climate-friendly and competitive production, the German government developed the steel action plan in 2020. It is based on three main pillars:

- Climate protection, through the reduction of CO2 emissions,

- competitiveness through fair market conditions and investment promotion,

- Social responsibility to preserve jobs and industrial value creation

One key aspect is the decarbonization of steel production by switching from coal-based blast furnaces to the so-called direct reduction process with hydrogen.

In conventional blast furnaces, carbon from coke is used to remove the oxygen from the iron ore. In direct reduction, hydrogen takes over this task. As a result, water vapor is produced instead of CO2, which leads to a drastic reduction in emissions.

Electric steel production also plays a key role, as recycled steel scrap is melted in electric arc furnaces, a process that consumes significantly less energy and avoids CO₂ emissions compared to traditional pig iron production. However, this requires access to sufficient renewable energy at competitive prices.

In addition, expenditure on research and innovation is to be stimulated in order to make new technologies such as “green steel” economically viable.

The concept also provides for trade and industrial policy measures, such as CO₂ border adjustment systems, to offset international competitive pressure, particularly from cheap imported steel from countries with lower environmental standards.

The aim is to preserve steel production in Germany in the long term, protect jobs and make the industry climate-neutral and fit for the future

Conclusion

While steel is an indispensable material for many key industries and plays an important role in the German economy, the industry is facing enormous challenges due to the need for decarbonization, international competitive pressure and rising electricity prices.

Targeted political measures and investments in climate-friendly technologies are essential in order to remain competitive and sustainable in the long term. If the industry manages a transformation to green steel production, particularly through the increased use of hydrogen and electric steel, this can strengthen Germany as a business location again and at the same time make a significant contribution to climate protection.

How do you see the future of the steel industry in Germany? Please share your perspectives with us!

With best regards

Your HANSE Interim Management

Andreas Lau